Get signers verified before signing important documents

Verify your signer’s identity through e-KYC (Electronic Know Your Customer) procedures with the highest security. Ensure seamless verification for local and global users, with guaranteed zero risk of data leaks.

- Official e-KYC procedures according to the law

- Aplicable for local and global users

- Suitable for various industry’s onboarding

- Verify, then sign & stamp within one platform

35.000+ companies across the globe have trusted Mekari

eKYC benefits for your business

Know who your customers are

Safeguard your business with a verification flow that complies with applied regulations. Verify documents, get proof of address, and perform user screening to ensure full compliance.

Detect and prevent fraud earlier

Keep fraudulent actions out while maintaining seamless access for legitimate users. Validate IDs, conduct liveness checks, and detect potential scam activities with precision.

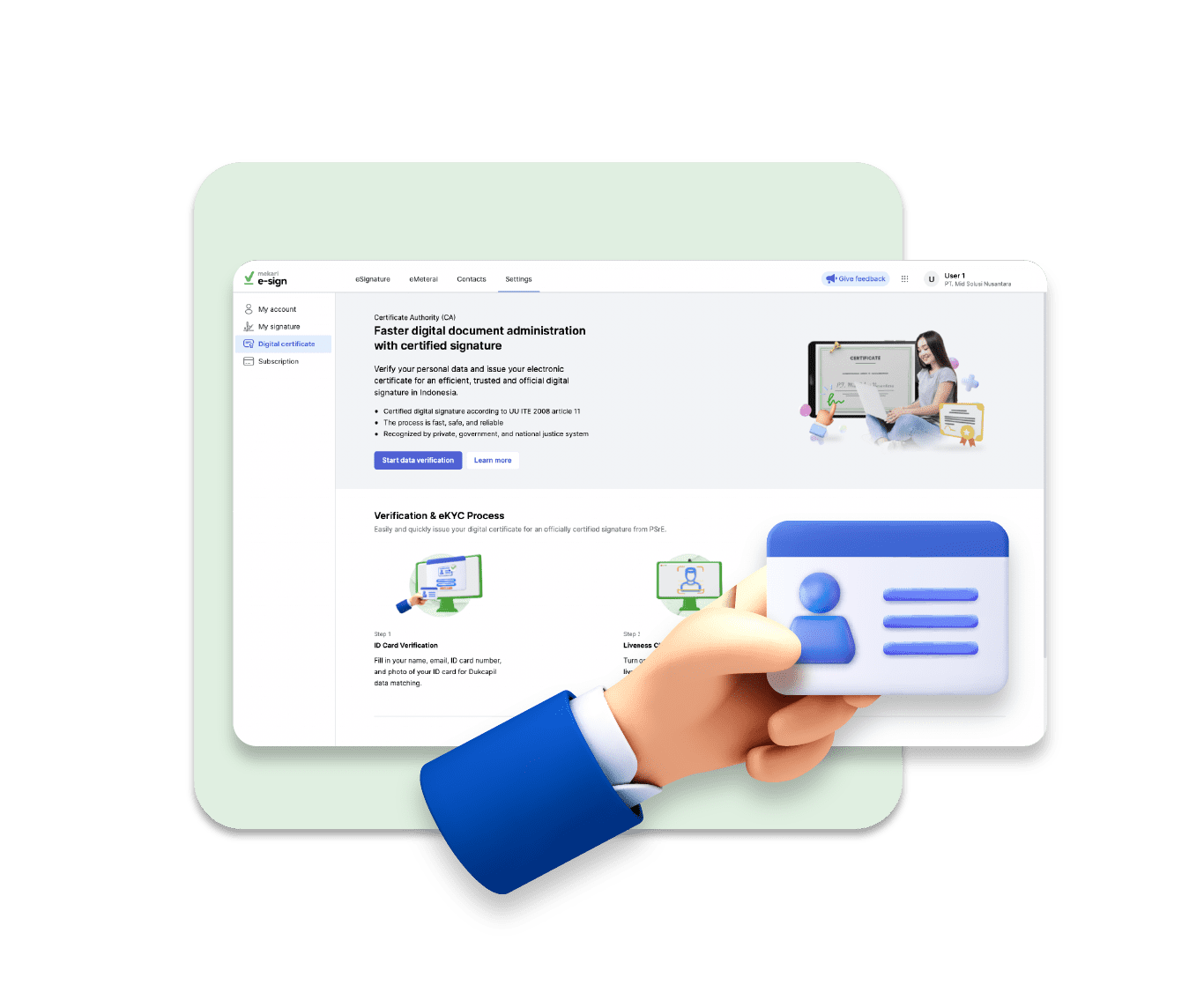

4 Simple steps to complete the eKYC process

Mekari Sign’s eKYC can be done within these steps:

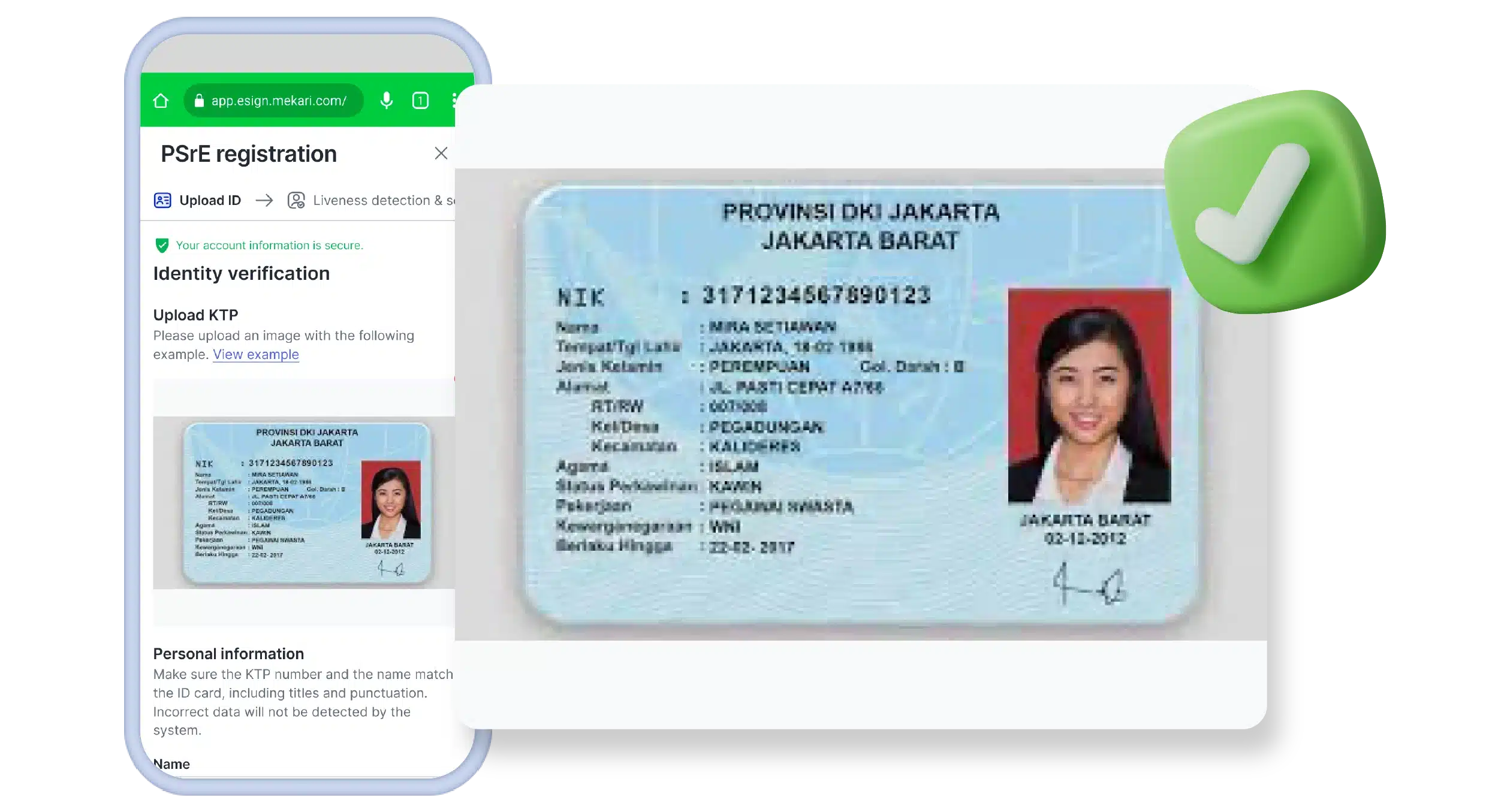

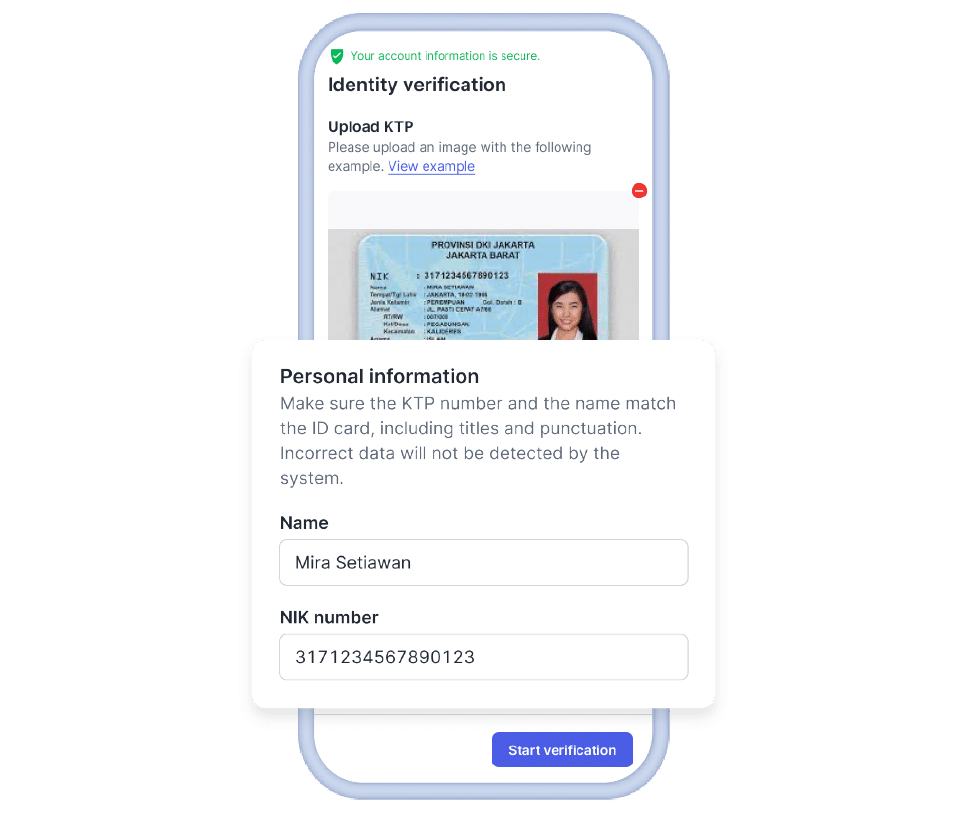

- Upload your eID

Upload a picture of your eID and fill in the personal information fields. Make sure they match before proceeding.

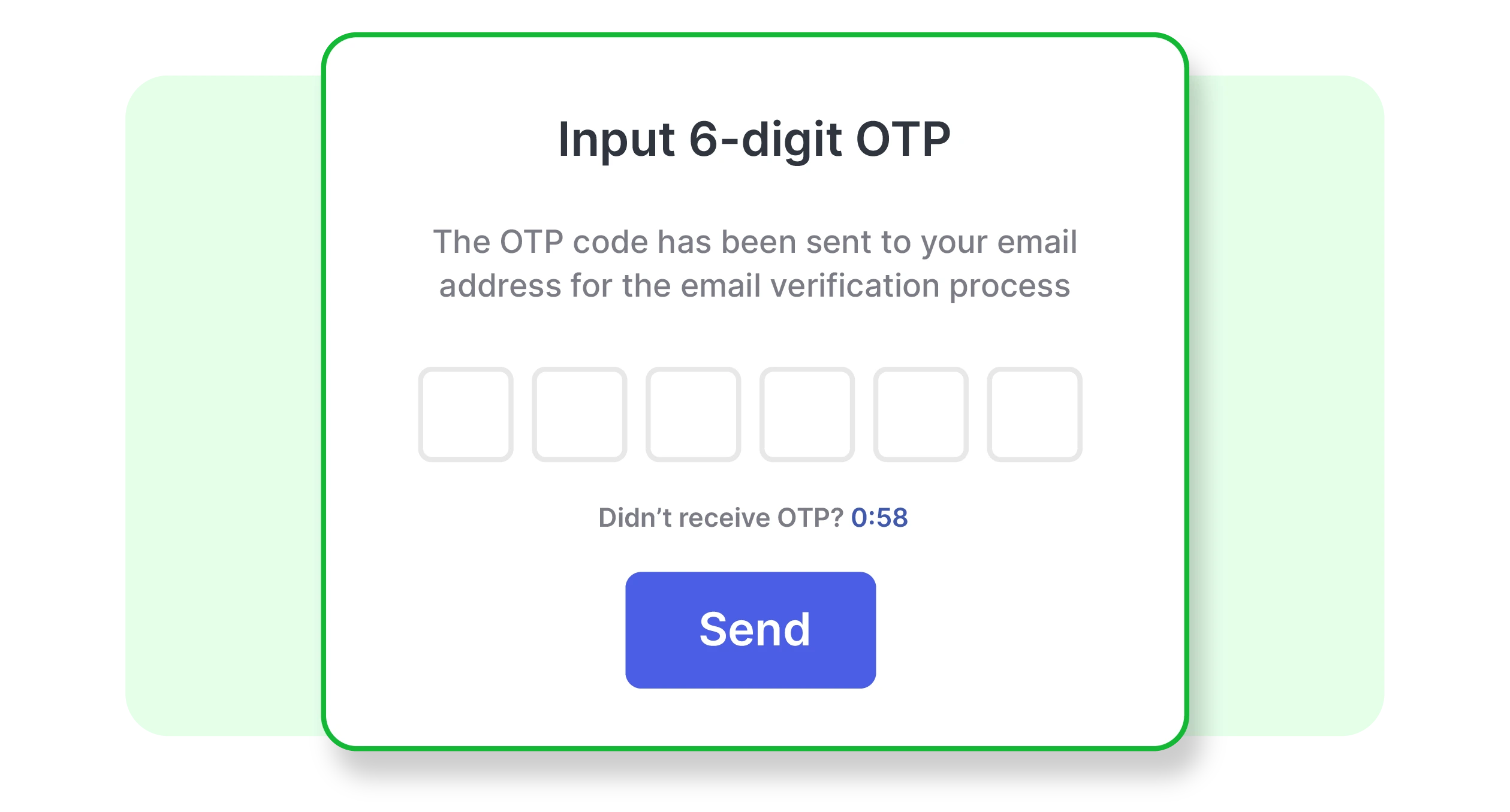

- Submit the OTP

You will receive a one-time OTP code before proceeding with the verification. This helps reduce fraud & scams.

- Do the liveness check

Turn on your webcam and face the camera. The liveness check will recognize the signer’s authenticity.

- Wait for the verification

Once done, wait 1×24 hours for the system to verify your identity. If successful, you will receive the certificate; if not, you’ll be able to redo the eKYC.

What is eKYC?

eKYC or electronic know your customer is a series of procedures to identify and verify a user’s identity digitally, without any physical contact. This procedure contains a series of user inspections that are done in the first phase before users can continue to use our products. The goal is to ensure that the user is indeed in accordance with the identity provided.

Usually, an institution such as a bank or insurance company needs to verify their prospective customer or customer to ensure that the customer is really his real identity. The eKYC process will help agencies so that there is no need for a customer to come to a branch office to do KYC physically.

Is eKYC safe for the user's identity?

It’s safe because the verification process uses your data at Dukcapil, so the results are accurate. In addition, the electronic identification process follows high-security rules according to AML5 (Fifth Anti-Money Laundering Directive) and eIDAS (electronic Identification, Authentication, and Trust Services).

All products from Mekari Sign have guaranteed safe. You can get features such as electronic signature, eMeterai, online stamp (coming soon), electronic contract, and audit trail to help with business administration processes.

How long does the eKYC process take?

To complete the eKYC process, the verification process only takes a few minutes after you complete all the required data. This is because eKYC is completely digital and real-time, so it doesn’t take weeks like regular KYC.

Is KYC important?

Yes, because eKYC procedures are done to verify that the user matches the identity provided.

What causes eKYC to be rejected or fail?

There are several reasons your eKYC was rejected or failed:

- There is a problem with your identity card photo, such as unclear writing, damaged parts, or blurred signature.

- The quality of the photo when checking the liveness that you upload is not clear; too dark, too far away, or covered by light reflections.

- Problems with your internet connection, so the verification process is constrained. This could cause the photos you uploaded didn’t upload properly.

- Checking identity and photos when liveness is proven not to be the same. That means there is a possibility of identity falsification.

What are the benefits of eKYC?

Here are the benefits or functions of eKYC:

1. Fast and Practical Process

All eKYC processes run digitally or online, so all the data you enter will be transferred in real-time without any manual intervention. This can speed up the verification process compared to regular KYC which can take weeks.

2. Facilitate Customers

Your customers don’t have to leave their houses, through the heat or rain, or get stuck in traffic just to do KYC in your office. All processes can be done in minutes through their smartphone. As a result, customer satisfaction will increase.

3. Reducing Fraud

The KYC process manually is prone to fraud because the process takes longer time and has many loopholes that can be exploited. This can be reduced with eKYC since the verification is done in real time by matching your data at DUKCAPIL.

4. Cost-Effective

eKYC is completely digital, so you don’t need to provide your office, staff, paper, pen, ink, and so on. This way, you will save a lot of costs that can be allocated to other business needs.

5. Environmentally Friendly

eKYC is an eco-friendly technology. You don’t need to print hundreds or even thousands of sheets of paper for the customer verification process. All processes occur digitally, so you can help preserve the environment.